Accounting tasks can test the nerves of a start-up owner. Let us face it! The owner never thought about the gleeful pleasure of performing accounting tasks and functions. Building a new enterprise might come with different goals – mostly monetary benefits – but one can never overlook the significance of accounting activities. Being an entrepreneur, you must be wise enough to consider the best actions to streamline your accounting department.

You can follow various tasks and actionable activities to uplift your accounting department. Of all the tasks and strategies you can follow, using a cloud-based accounting software will help you the most. It is time to consider Xero implementation in your start-up, as this cloud-based software will streamline your accounting activities. This post will uncover other helpful accounting tips that you should know. Keep reading to learn more!

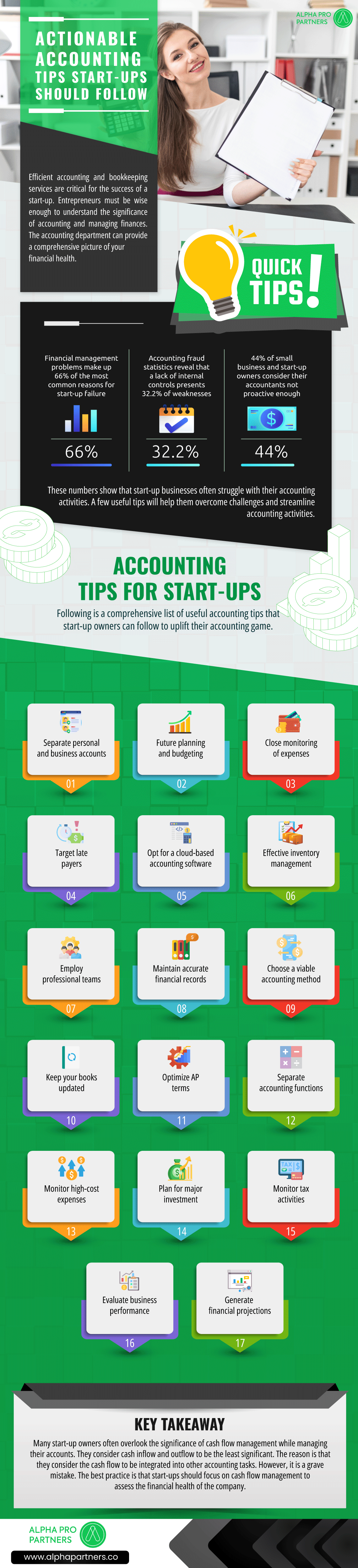

Efficient accounting and bookkeeping services are critical for the success of a start-up. Entrepreneurs must be wise enough to understand the significance of accounting and managing finances. The accounting department can provide a comprehensive picture of your financial health.

Quick Facts:

- Financial management problems make up 66% of the most common reasons for start-up failure.

- Accounting fraud statistics reveal that a lack of internal controls presents 32.2% of weaknesses

- 44% of small business and start-up owners consider their accountants not proactive enough

These numbers show that start-up businesses often struggle with their accounting activities. A few useful tips will help them overcome challenges and streamline accounting activities.

Accounting tips for start-ups:

Following is a comprehensive list of useful accounting tips that start-up owners can follow to uplift their accounting game.

- Separate personal and business accounts

- Future planning and budgeting

- Close monitoring of expenses

- Target late payers

- Opt for a cloud-based accounting software

- Effective inventory management

- Employ professional teams

- Maintain accurate financial records

- Choose a viable accounting method

- Keep your books updated

- Optimize AP terms

- Separate accounting functions

- Monitor high-cost expenses

- Plan for major investment

- Monitor tax activities

- Evaluate business performance

- Generate financial projections

Key Takeaway:

Many start-up owners often need to pay more attention to the significance of cash flow management while managing their accounts. They consider cash inflow and outflow to be the least significant. The reason is that they consider the cash flow to be integrated into other accounting tasks. However, it is a grave mistake. The best practice is that start-ups should focus on cash flow management to assess the financial health of the company.

Learn More:

Xero: The Unbeatable Choice for Accounting Software

30 Clear Signs That Your Business Has Outgrown Your Accounting Software